What really drives e-mobility

The ultimate breakthrough in e-mobility will be achieved when the costs of battery production reach the level of a classic combustion engine. We're not far away from that right now.

Text: Daniel Fauser and Manuel Renz

The heart of an electric vehicle (EV) is the battery pack and not the engine, as is the case with a conventional combustion engine. The cost of the battery pack now accounts for a quarter to a third of the total cost of an EV. It is the largest individual cost component. The battery pack therefore plays the main role in reducing the cost of EVs.

Battery production costs coming down

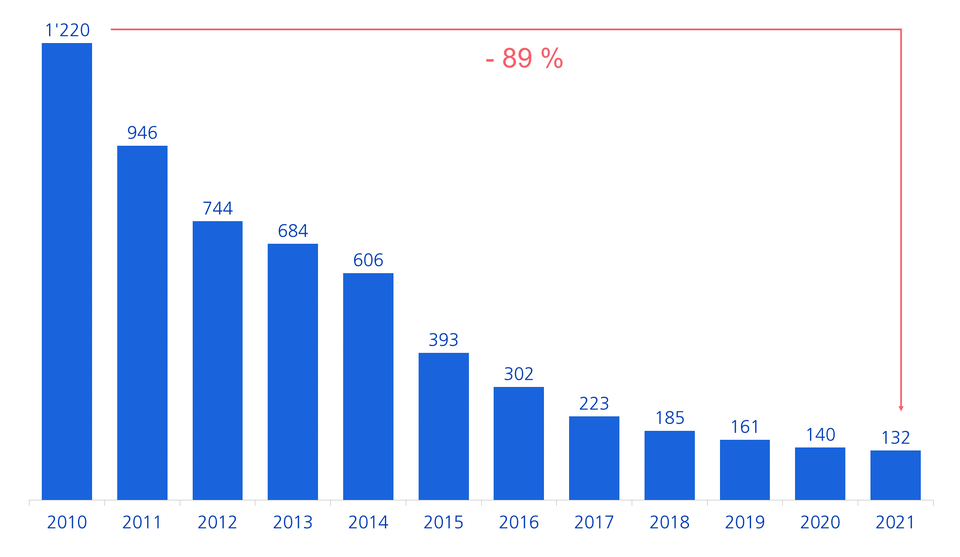

Manufacturers of battery packs have made great progress in reducing costs in recent years. The battery price fell from USD 1,220 per kWh in 2010 to USD 132 per kWh in 2021, i.e. by over 89%.

Development of production costs in USD for battery modules

The main drivers of these cost reductions include:

- Scaling advantages in capital-intensive production

- Significant technological advances, especially in increasing energy density (in kWh/kg)

- Advances in battery design and chemical composition (e.g. lithium-iron phosphate batteries and cell-to-pack technology)

Cost parity in sight

Research and the market assume that cost parity between EVs and vehicles with combustion engines – under otherwise identical conditions – would be achieved at battery costs of around USD 100 per kWh. As a result, EVs are expected to be cost-competitive in just a few years compared to vehicles with combustion engines, which should continue to fuel acceptance by the end customer and thus EV growth.

This growth is likely to be reflected in the earnings figures of large and well-known battery manufacturers such as a Contemporary Amperex Technology Corp., LG Energy Solution, BYD or Samsung SDI over the next few years.

Swisscanto Invest follows developments in the market and in battery technologies very closely and implements them in sustainable, global equity strategies, where appropriate, taking into account quality aspects (profitability, debt, etc.). At present, the focus of our investments is on the market leaders in battery production in the Asia-Pacific region.

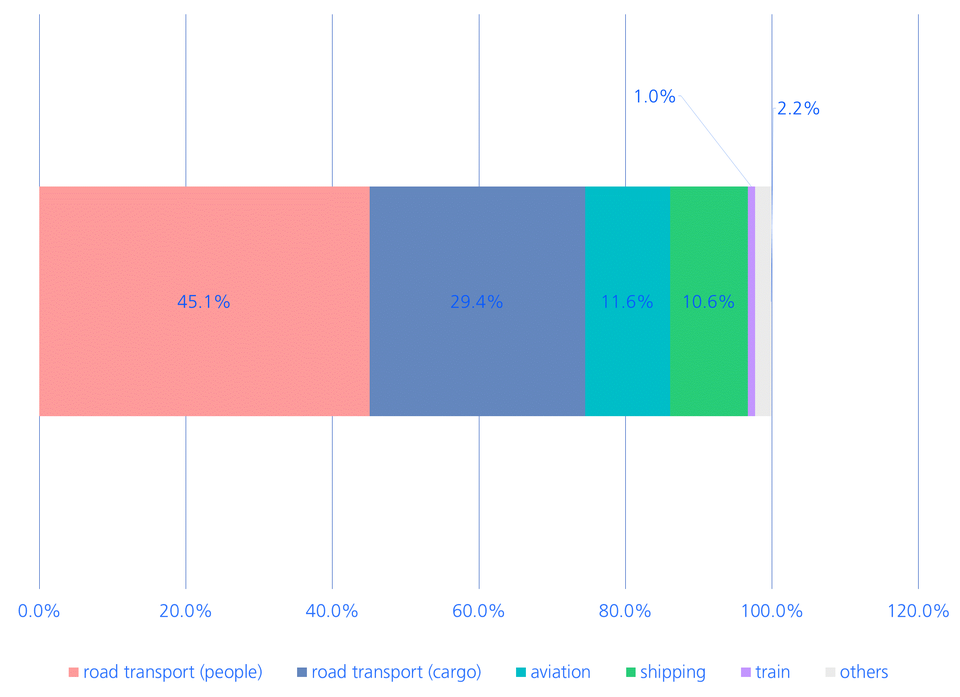

Increasing mobility gives a boost to EVs

Constant cost reduction in battery manufacturing is an important factor in helping EVs to achieve a breakthrough. A second important factor is the increasing awareness in politics and society for the accelerated decarbonisation of the economy. The transport sector is known to be one of the largest emitters of CO2. For example, the recovery of the global economy and tourist travel in 2021 led to an increase in global CO2 emissions to 33 gigatonnes, bringing emissions back almost to 2019 levels after the decline in 2020. The transport sector accounts for almost a quarter, 8.2 gigatonnes (24%), of these emissions. Of these 8.2 gigatonnes, 45% are for passenger road transport alone and a further 29% for freight transport.

Global share of CO2 emissions in % by mode of transport

EVs and batteries benefit from multiple developments

In addition to the key factors outlined above, there are also other key growth drivers for manufacturers of EVs and batteries. These are:

- Effectiveness for decarbonisation: According to data from the International Energy Agency, EVs already cause an average of 50% less greenhouse gas emissions over the entire life cycle than vehicles with combustion engines (depending on the CO2 intensity of the electricity mix).

- High demand: In the fourth quarter of 2021, EV sales rose by 134% to a record high compared to the same period last year. The market research firm Bloomberg New Energy Finance (BNEF) predicts that EVs could account for 29% of total new vehicle sales in Europe and 25% in China as early as 2025.

- Purchase subsidies: Government grants reduce purchase costs, but vary greatly from country to country and can range from EUR 2,000 (Finland) to EUR 12,000 (Singapore) per vehicle.

- Improved charging infrastructure: The annually newly installed charging connections have increased almost eight-fold from around 200,000 in 2015 to 1.5 million in 2021.

- Government phase-out targets: The adoption of regional and national targets for phasing out combustion engines has increased sharply in recent years (e.g. Norway by 2025, United Kingdom by 2030 and Canada by 2035).

Legal notice: The publications were prepared by the Buy-Side Research of the Asset Management of Zürcher Kantonalbank. The information contained in this document has not been prepared in accordance with any legislation promoting the independence of financial research, nor is it subject to any prohibition on trading following the dissemination of financial research.