Turkey: High credit growth entails high risks

Political hubbub has shifted attention away from Turkey's economic development. The country's relatively rapid economic recovery over the past 12 months has been driven by the government's preference for very high credit growth. This has further exacerbated the risks to Turkey's financial stability.

Text: Enzo Puntillo and Rocchino Contangelo

Monetary policy has taken numerous steps to encourage or even oblige Turkish banks to increase their lending. Interest rates were lowered several times last year, as well as in spring 2020. In May this year, a new asset ratio was also introduced, penalising banks that are slowing down lending.

Strong credit growth in Turkey

Figures in percent compared to the previous year

Negative real interest rates

Rapid credit expansion combined with loose monetary policy comes at a price. Despite the key interest rate of 8.25%, real interest rates in Turkey are among the lowest in the entire bond universe at -3%. Inflation remains high at 11.8% year-on-year and it is not showing any signs of a development that would be suitable for raising real interest rates.

Cash inflows remain scarce

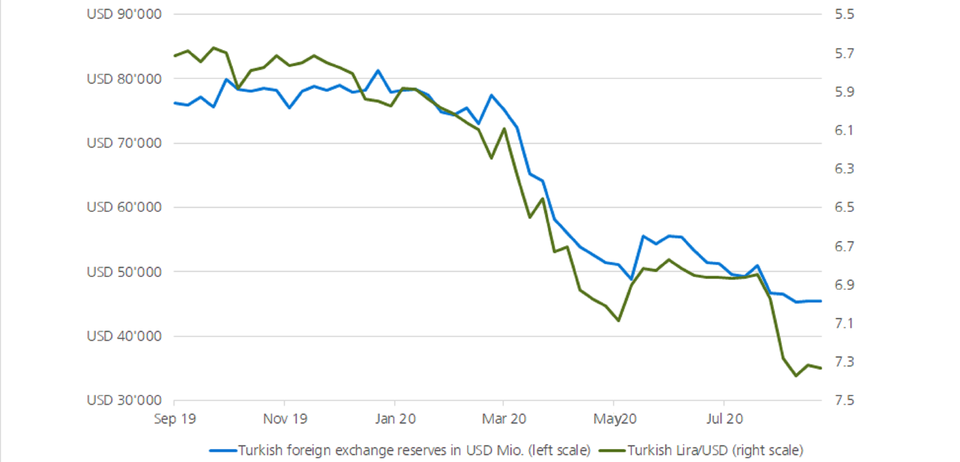

We expect capital inflows to remain low in the coming months given the unattractive real yields and high political and economic risks. Current account inflows from the tourism sector have stagnated at very low levels – only 4% of the previous year's figure in June 2020 and 14% in July 2020.

An interest rate increase currently only through the back door

The central bank has dispensed with the necessary interest rate hike out of obedience to President Erdogan. We expected this to happen. Instead, the central bank announced an increase in reserves that banks must hold with the central bank for deposits in foreign currencies and lira.

Keeping at a distance

We maintain our view that Turkey's problems due to its unsustainable economic policy will continue to increase in the future. With high inflation, rapidly declining foreign currency reserves and considerable public and private foreign currency debt, coupled with low investor confidence, the Turkish lira will continue to underperform or even come under pressure in the coming months. The weakness of the lira is already pronounced today – even more so than during the Turkish "currency crisis" of 2018 (see chart below). We are avoiding both Turkish bonds and the currency.

Consequences also on the equity side

On the equity side, we have analysed Turkey as part of our active fundamental research process and have concluded that we do not wish to take an active position in the case of Turkey. The proportion of Turkish equities in the benchmark relevant to us, the MSCI Emerging Markets, is very low. Fundamental analysis has shown that the valuation of equities is barely consistent with the fundamental data. In these circumstances, it is not worth taking a Turkish risk. Overall, there is currently no risk-reward for positioning in Turkish equities.

Turkish lira and foreign exchange reserves are ice cubes melting in the sun