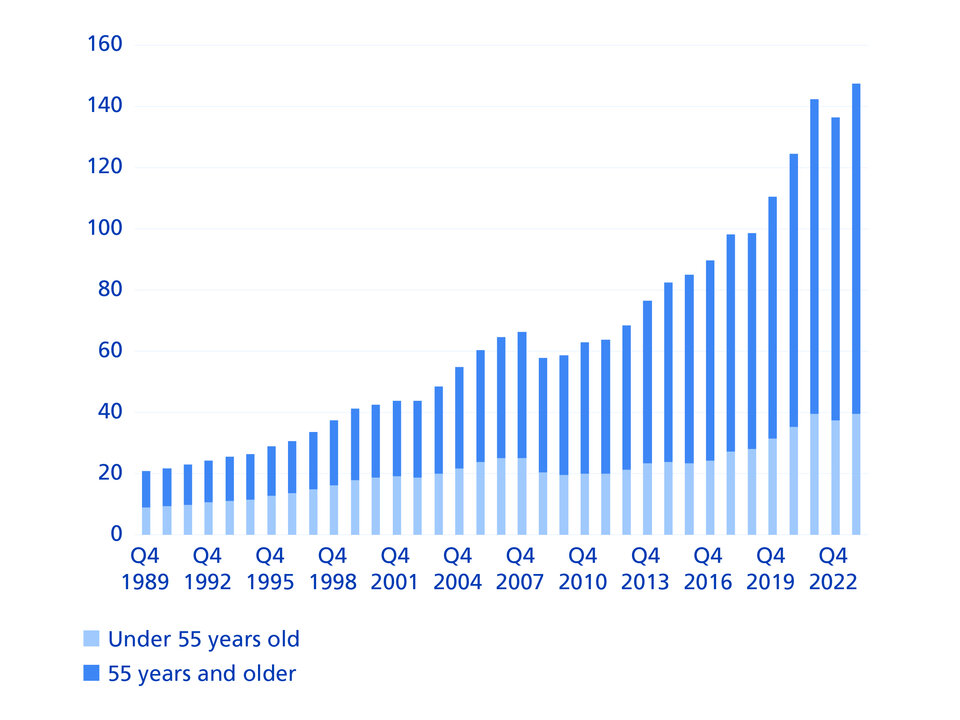

Affluent baby boomers

The current over-65s in western countries are wealthier than any older generation before them.

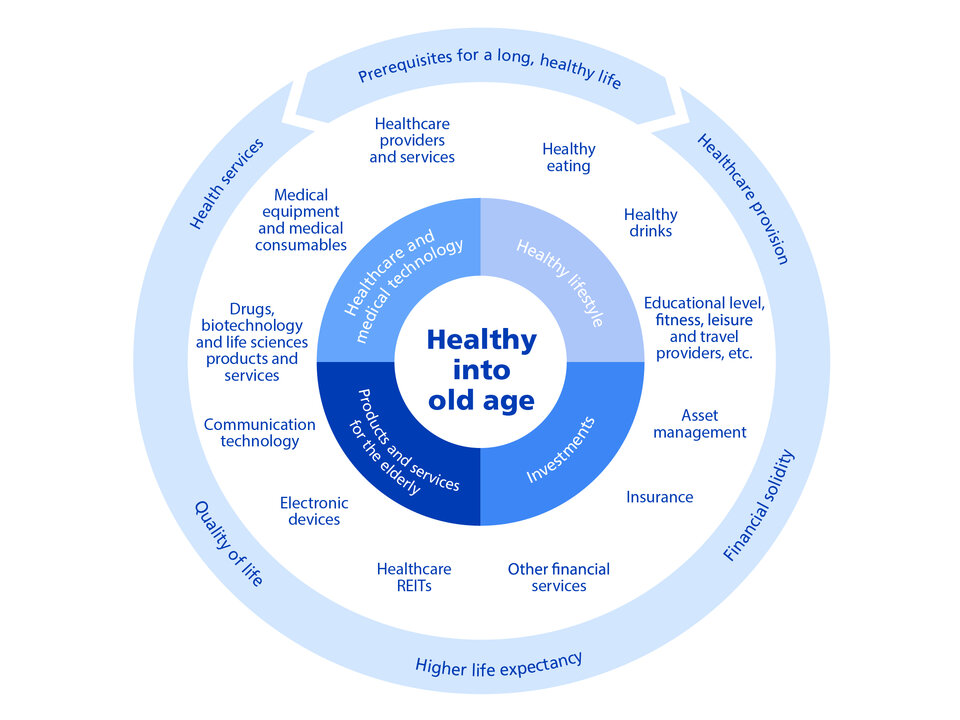

Not only are more and more people reaching old age, they want to do so while still enjoying good health. This is something they are prepared to pay for at a young age. The analysis shows the enormous potential of the longevity trend for investments – and also highlights the challenges from a sustainability perspective.

By 2050, the number of people over the age of 65 is expected to double to more than 1.59 billion1. At the same time, the baby boomers in western countries are more prosperous than any older generation before them.

The growing demographic weight of the baby boomers, along with their assets and purchasing power, promise a long-term boost for what is known as the silver economy – the market for products and services specifically geared towards the needs of the elderly. However, awareness of health and well-being is also growing among younger generations, making healthy longevity equally relevant to both young and older people. At the same time, this approach promises structurally effective solutions to the challenges of demographic change. Products and services related to healthy ageing can therefore support several United Nations Sustainable Development Goals (SDGs), such as the goal of good health and well-being.

We have translated the trend towards healthy longevity into an investment concept that takes into account what we believe to be the structural growth drivers. According to our analysis, companies and sectors that can be allocated to the following areas of investment can benefit from this: healthy lifestyle, healthcare and medtech, finance and silver economy products and services. Besides companies that directly support healthy longevity as "enablers", solution providers who provide services and products for health-conscious younger and older people are also relevant in our approach.

Demographics is the most important driver of the growing demand for products and services in the field of healthy longevity. Although it appears relatively slow, it is unlikely to lose any momentum in the coming decades. However, this future theme is highly complex. This is why funds actively managed by experts can offer great added value: Swisscanto has many years of in-depth expertise in sustainable thematic funds.