Where are we invested?

The Swisscanto Private Equity Funds have so far invested in these promising Swiss and international growth companies. Five of them have already had a successful exit - an overview.

Overview of all investments and exits

The Swiss Growth Fund was launched in autumn 2018 and offers qualified and institutional investors exclusive access to unlisted growth companies. The fund portfolio currently comprises the following 18 companies of swiss and international provenance. Five of them have already had a successful exit.

Current portfolio

ANYbotics

ANYbotics

ANYbotics is an ETH-spin-off, coming out of the world-renowned lab of Prof. Dr. Roland Siegwart. The company-offers an end-to-end solution consisting of autonomous mobile robots and a software stack empowering customers to operate plants without human presence. The robot is deployed to collect data, to continuously monitor infrastructure and to automate inspection and maintenance tasks in harsh, hazardous, and complex environments. Further, ANYbotics offers the only legged robot with "Ex-Certification", which means that the robot can be used in explosive environments for instance in Oil & Gas, Chemical Industry, etc.

Beekeeper

Beekeeper

Beekeeper was founded in 2012 by ETH graduates Cristian Grossman and Flavio Pfaffhauser. The company is headquartered in Zurich, where the management as well as most of the staff are located. Beekeeper is a "Team-Communication-App" enabling real-time connectivity and communication with mobile "non-desk workers" in a fast and secure manner. The company aims to become the main productivity and collaboration platform for frontline workers, which enables operational processes to be digitized and more effcient. Beekeeper has more than 200 employees across Europe and the US.

Distran

Distran

Distran is an ETH spin-off, founded by Joël Busset und Florian Perrodin. The company's patented technology allows detection of gas leaks up to ten times faster than conventional methods, making a direct contribution to reducing greenhouse gas emissions. With its technology, Distran aims to save more than 100 million tons of CO2 equivalent by 2026. This is equivalent to the volume of greenhouse gases emitted by around 21 million cars annually. The company develops, manufactures, and sells acoustic cameras, each equipped with 124 microphones, which can register the smallest leakages from gas pipes, etc. The cameras detect noises in the ultrasonic range, which are then visualized on the camera display. These Distran "super ears" are even used on NASA space missions to detect leaks in the space capsule at an early stage.

Ecorobotix

Ecorobotix

Ecorobotix - AI-controlled plant treatment: The growth fund invested in the AgriTech company based in Yverdon-les-Bains in October 2023. The flagship product is called ARA. It is an AI-supported plant recognition system that treats plants in a targeted manner. It enables farmers to work more efficiently and protect the environment at the same time. Last May, a further financing round totalling CHF 46 million was completed. Among other things, the money is to be used to expand the business on the American continent.

Fotokite

Fotokite

Fotokite is an ETH spin-off founded in 2013 and is headquartered in Zurich. The company provides an aerial data intelligence platform with invaluable overview information for frefghters and public safety teams to help them manage complex, safety-critical situations. The company has developed a tethered drone equipped with a video and infrared camera that allows for real time broadcasting, on-site and remote analysis as well as after event review and reporting. The drone is stored in a rooftop box and is ready for operation in the air within 90 seconds at the single push of a button.

GetYourGuide

GetYourGuide

GetYourGuide - an investment from the very beginning: the former ETH spin-off is an agent for travel experiences, tours and admission tickets around the globe. The Growth Fund has been an investor since December 2018, while Zürcher Kantonalbank invested in the company in the very first financing round back in 2009. GetYourGuide regularly sets new sales records and impresses investors. In a recent financing round, GetYourGuide secured almost USD 200 million. With a market value of over one billion Swiss francs, the company is one of a small group of "unicorns" of Swiss origin.

Medimaps Group

Medimaps Group

The Medimaps Group is a Geneva-based medtech company that has developed image processing software for assessing bone health. Thanks to the patented deep learning algorithms, osteoporosis diagnosis is faster and more comprehensive, allowing up to 30 per cent more patients at risk of fracture to be identified. The core technology is being further developed for additional medical indications in the field of orthopaedics and for primary screening from X-ray and CT images. The Swisscanto Growth Fund has been invested since November 2021.

MedTrace Pharma

MedTrace Pharma

MedTrace is located in the greater Copenhagen area (DK). The company was founded by Martin Stenfeldt, Rune Wiik Kristensen and Peter Larsen in 2015 with the purpose to improve the diagnostic accuracy in PET perfusion imaging by enabling the use of the gold standard perfusion agent 15O-Water. It's frst commercial application will be cardiac perfusion. Further applications namely in oncology are under development in collaboration with reputable clinics worldwide.

Medtrace has developed a small GMP production device for 15O-Water located next to the PET scanner, devices for fast and accurate dosing and an own blood fow quantification software which facilitates diagnosis signifcantly. In Europe the company is already selling products under "magistral exemption" in specifc countries and selected clinics. In the US an additional phase III clinical study is required for market authorization. In 2022, the company received the approval for the clinical study, established an offce in the US and started to enroll patients. The company adjusted its strategic direction by focusing strongly on clinical and regulatory milestones, in order to have a strong product launch in the USA no later than 2025.

Memo Therapeutics

Memo Therapeutics

Memo Tx was founded 2012 by Christoph Esslinger as an ETH spin-off and has its headquarters in the Zürich area. The company is an innovator in the feld of antibody discovery and immune repertoire analysis. Exploiting the power of Memo's microfluidic single-cell molecular cloning and screening technologies, the company engages in antibody discovery across species and indications for proprietary and partnered projects.

The current pipeline focuses on medications against infectious diseases. In 2022, two phase I clinical trials were started on BK virus and Covid-19. The safety study on Covid-19 was concluded and Memo Tx's antibodies were found to be very safe. Nevertheless, the company in consolidation with BAG decided to stop the project based on the current Covid-19 developments. The phase I study for the BKV has been completed with positive results on safety. Memo Tx received a FDA fast track designation for AntiBKV as treatment of BKV infection in renal transplant patients. The company started their U.S. pivotal phase II trial in April 2023.

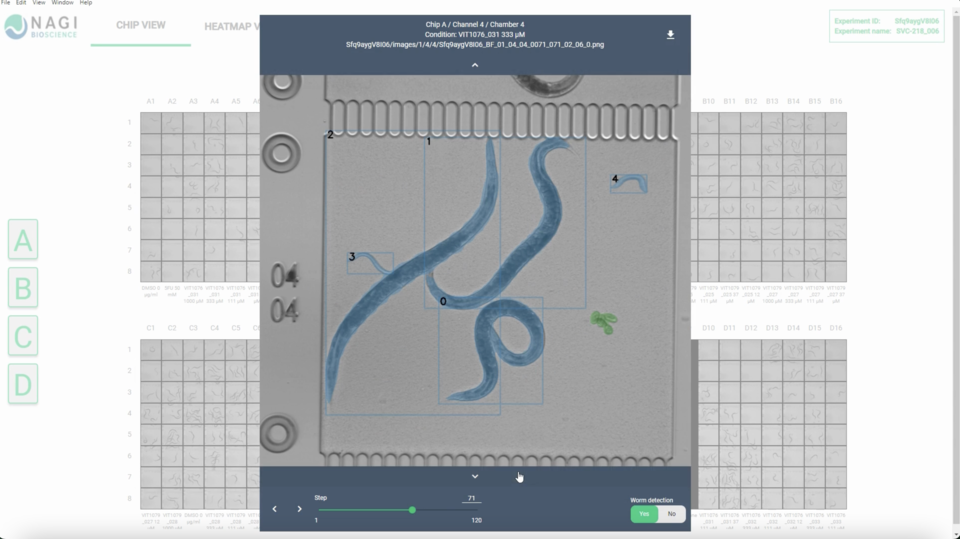

Nagi Bioscience

Nagi Bioscience

Nagi Bioscience - mini worms instead of vertebrates. The biotech company domicilised near Lausanne uses innovative laboratory equipment to make tests on vertebrates obsolete in many cases. Instead, novel drugs are tested on pain-resistant nematodes. Dozens of tests can be carried out with one experiment. Analyses and evaluations are carried out digitally. Last September, the Swisscanto Growth Fund participated as a co-lead investor in a CHF 12.4 million financing round. Zürcher Kantonalbank has been on board as an investor since the start-up phase in 2019.

OncoDNA

OncoDNA

OncoDNA is an oncology-focused healthcare technology company that was founded in 2012 by Jean-Pol Detiffe. The company is located in Gosselies (B) and has an additional offce in Paris (F), after its acquisition of Integragen SA.

The company provides diagnostic solutions to doctors, clinics and pharmaceutical companies applying proprietary technology on DNA and RNA sequencing, biomarker analyses based on solid and liquid biopsies resulting in clinically relevant information. The information is then compared with the company's own proprietary knowledge database. The end result is a comprehensive report that contains all relevant diagnostic information and possible treatment options.

The company has transformed its services into a Cloud-based solution for easier access and management of information and data. The database is constantly update and thereby "learns" on the go with each new report and/or data input. Pharmaceutical company client proft from the offering by designing and executing clinical studies more precise and more effcient. This precision medicine approach might later on also result in companion diagnostics for personalized cancer treatments.

SWISSto12

SWISSto12

Swissto12 - Satellites made in Switzerland: Founded in 2011 by EPFL graduates, the Swiss technology company produces satellite components using the 3D printing process. Its patented technology allows a high degree of flexibility at comparatively low production costs. Swissto12 works together with the European Space Agency (ESA). At the end of last year, Intelsat, the world's leading provider of satellite services, was acquired as a customer. Another deal was recently finalised with Inmarsat. The company is on a strong growth path and offers investors excellent economic prospects.

Varjo Technologies

Varjo Technologies

Varjo was founded in 2016 by a team of world-class augmented reality experts, already then with significant experience in the field from Nokia and Microsoft.

The company primarily designs professional-grade mixed / augmented reality devices and provides a collaborative software platform called "Varjo Reality Cloud", which allows the ultimate science fiction dream, photorealistic virtual teleportation, to come true. The user can watch and manipulate the simulated environment in the same way they act in the real world without any need to learn how the complicated user interface works. This is especially relevant for training, simulations, and product design. Varjo has over 1000 customers today, including global blue-chip customers such as Boeing, Lufthansa, Airbus, Siemens, Philips, Rolls Royce, Autodesk, Volkswagen, Toyota, and ETH Zurich.

Already realised Exits

1plusX

1plusX

USD 150 million for 1plusX: The Zurich-based software company developed data-driven analyses for marketing purposes and was successfully sold to the US advertising technology company Triplelift in March 2022. The growth fund became an investor in 1plusX in December 2020.

Versantis

Versantis

Strategic acquisition of Versantis: The French pharmaceutical company Genfit acquired the biopharmaceutical company Versantis last September. The sellers will receive additional milestone payments if the technology is successfully developed further.

Creoptix

Creoptix

Successful exit of Creoptix: The healthtech start-up Creoptix was acquired by the British company Malvern Panalytical at the beginning of 2022. The special thing about it: Zürcher Kantonalbank was on board as an investor in Creoptix from the very beginning.

Sulzer & Schmid Laboratories

Sulzer & Schmid Laboratories

Sulzer & Schmid Laboratories has been sold to the London-based RES Group. The global renewable energy company will expand its service portfolio with Sulzer Schmid's platform for the fully automated inspection of rotor blades using drones. In addition, the acquisition strengthens RES' breadth of digital solutions and services to meet the growing demand from renewable energy asset owners for smart, data-driven operations and maintenance.

NIL Technology

NIL Technology

NIL Technology, a high-tech company specialising in optical sensors, was sold to Taiwan-based Radiant Opto-Electronics (ROE). Swisscanto's Swiss Growth Fund invested in NIL Technology in 2021.

The Global Decarbonization Fund offers professional and institutional investors exclusive access to growth companies that are driving forward the climate transformation of the economy. The fund portfolio currently comprises two direct and four indirect investments.

Direct investments

Tado

Tado

tado° is the European leader in intelligent home climate management. As the only cross-manufacturer platform, tado° Smart Thermostats and services connect with any kind of heating or cooling system. Customers beneft from energy-saving technology such as Geofencing and Open Window Detection as well as time-of-use energy offerings. Founded in Munich, 2011, and with 180 employees, tado° reshapes the way energy is consumed for more comfort, savings, and in sync with nature.

Monta

Monta

Monta has developed a software platform for the operation of charging stations for electric vehicles. Monta's services offer cost benefits and revenue models for private individuals with their own charging station as well as for large charging station operators, property managers, installers and energy supply companies. For example, it is possible to specify when and under which conditions (e.g. most favourable electricity price) the electric car should be charged. The Danish start-up was founded in 2020 and already employs over 200 people.

AMCS

AMCS

AMCS offers modern software solutions for waste and recycling processes. The solutions also include modules for operations management, financial management and payment processing. In addition, AMCS provides logistics software for route optimisation and fleet management. The globally active company, based in Ireland, aims to improve operational efficiency, compliance, and sustainability for companies in the waste and environmental sectors.

Indirect investments

Ambienta

Ambienta

Ambienta was founded in 2007 and provides a thematic fund opportunity with a long history in sustainability investing of three previous and successful fund generations. Ambienta IV invests in growth & buyout mid-market companies and focuses on investments driven by long-term environmental sustainability key drivers, Resource Efficiency and Pollution Control.

Ara Partners

Ara Partners

Ara is a North American mid-market focused private equity manager, with now three fund generation focusing on industrial decarbonisation. Ara Fund III is seeking control investments in portfolio companies in North America and Europe, that are replacing incumbent processes with low-carbon alternatives.

EQT

EQT

EQT, founded 1994, provides with EQT Future a thematic fund opportunity using a purpose driven long hold buyout strategy. It is premised on an active ownership and invests in downside protected, mature market leaders with high profitability and cash generation, while driving impact at scale within Climate & Nature and Health thematics.

TPG

TPG

Founded in 1992, TPG is one of the largest alternative asset managers with approximately USD 210 billion in combined assets. Its platform includes private equity, private credit, real estate and public equity strategies. "TPG Rise Climate II" focuses on combating climate change while targeting strong financial returns. The fund invests in buyouts, carve-outs and growth companies.